The CPA Exam

The following video recording is an overview of each part of the CPA exam, as well as tips for studying each section.

Steps to Becoming a CPA:

Meet the Educational Requirements

California: 150 Semester Units, 24 Semester Accounting Coursework, 24 Semester Units Business Coursework

Licensure requires Ethics Exam as well as 1 year of work experience

Apply to take the CPA Exam

Register for the CPA exam here https://www.cba.ca.gov/cbt_public

Study for the Exam

Choosing an Exam Review Provider

Creating a Study Plan

Customize to your schedul/study style to prevent burnout

Studying!

Schedule the Exam

Recieve a Notice-to-Schedule (NTS)

Schedule Exam with Prometric

Succeed

Take the Exam, including the ethics exam

Obtain work experience

Apply for licensure

EXAM overview and sections:

Passing score: 75 on a 0-99 Scale

~18 Months to pass all four parts:

Financial

Content:

Conceptual Framework/Financial Reporting

Select Financial Statement Accounts

Select Transactions

State and Local Governments

Expected Study Time: 130-150 Hours (with foundation of intermediate and advanced accounting classes)

66 MCQ’s/90 min, 8 TBS/150 min

Audit

Content:

Ethics, Professional Responsibilities, and General Principles

Assessing Risk and Developing a Planned Response

Performing Further Procedures and Obtaining Evidence

Forming Conclusions and Reporting

Expected Study Time: 80-100 Hours (with foundation of auditing and advanced auditing classes)

72 MCQ’s/90 min, 8 TBS/150 min

Regulation

Content:

Ethics, Professional Responsibilities, and Federal Tax Procedures

Business Law

Federal Taxation of Property Transactions

Federal Taxation of Individuals

Federal Taxation of Entities

Expected Study Time: 100-120 Hours (with foundation of taxation and business law)

76 MCQ’s/90 min, 8 TBS/150 min

Business

Content:

Corporate Governance

Economic Concepts and Analysis

Financial Management

Information Technology

Operations Management

Expected Study Time: 80-100 Hours (with foundation of cost and management accounting, economics, information systems)

62 MCQ’s/90 min, 4 TBS/150 min, 3 written communication tasks (WC)/60 min

CPA Exam Tips:

● Take FAR → AUD → REG → BEC OR REG → FAR → AUD → BEC

○ OR I took FAR → AUD → BEC → REG and enjoyed that order. The other 3 have overlap and REG not as much. But REG has some overlap with BEC too

○ Audit after FAR was great because you need to know adjusting journal entries and overall have the accounting basis

○ Even BEC after FAR/AUD was also nice because of crossover with COSO, ratios, and other calculations

● Schedule your exams EARLY

○ Prometric fills up fast, to get optimal test time and date near cutoff, schedule months in advanced

○ (I had my next exam scheduled before even taking/passing the one I was taking)

○ You can move it for no charge up until a month beforehand, then there is a $35 fee until up to a few days before your exam date

● Take exams near cutoff period so you get your score back faster/maximize study time

○ AICPA website has score release timeline

○ Personal experience- try to do it at least the day before cutoff! Prometric can take up to 24 hours to submit your exam and if it is not received by cutoff, you have to wait until the next scoring window to get your score

○ You get your score on the NASBA Candidate Portal (the green website, not the blue one)

○ Scores release the day before they say they will! California typically gets it the day before around 11pm; other states get it at 4:30/5pm PST

● Once you have your test scheduled, make a study plan backwards from that date

○ Map out with modules you want to get done each week

○ 2 weeks of final review/taking mocks at the end (I did like 5 days final review and week to week and half of taking the 3 mocks and review on own)

■ The 3rd mock exam is within in the final review section and I have typically found more difficult than SE #1 and SE #2

● I would take SE #1, final review, SE #2 as order for mocks

■ Don’t freak out if you are on the 60’s for mocks, becker bump fluctuates for each exam but is definitely a thing

● Data of people’s mocks scores vs real scores

■ Note: for Audit I didn’t even do the formal final review / crammed “review” and mocks into a week cause I was down to the wire, do not necessarily recommend though

○ Aim for 2-3 big modules per week (but all depends on how big the modules are and how fast you personally are able to get through the material)

● Once you are in the groove of studying/can figure how much lecture you realistically can get through a day, make a day by day plan

○ Having a day by day plan shows how much you need to do every day to get it all done before your exam date

○ Helps with discipline

○ Also helps make it more manageable / not as overwhelming (in my opinion)

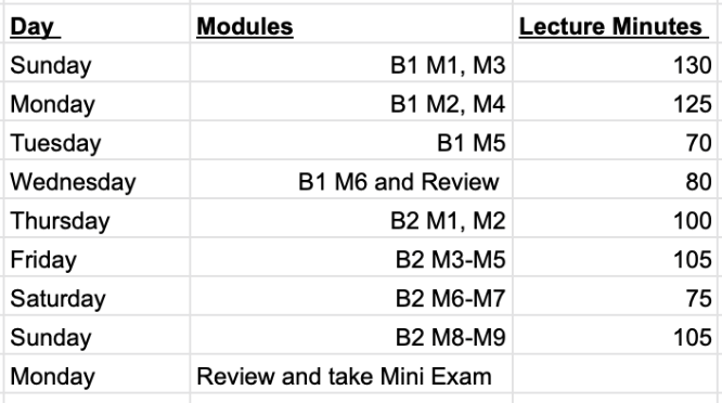

○ I use my excels to see how big modules are / break it up by time. I shoot for roughly 100-120 minutes of lecture per day MAX but just depends

● Review after each big module (whether thats making hand written study guides, typed study guides). Or before each mini. I especially did this for FAR but Audit slacked more

● Example Schedule below of “full time” studying:

○ * try to review after each module or before mini exams

○ *fluctuating time depends on if modules are like “part 1 and part 2” I try to do those on the same day. Or also would give myself less lecture on days I have things in life going on

● Skip SIMS that are not “important topics” doing every single SIM takes too long. Audit I didn’t do SIMS all together except for mini/mock exams or felt I needed practice

○ If you want, just watch the skill master videos on the SIMS instead of doing them for Audit

○ Can research on reddit or other places the “most important” topics for SIMS for each test

● Random advice:

○ Get your textbooks spiral bound at like FedEx Office to make writing in the margins easier

○ Get study guides from people or reddit then type into their notes to save time

○ Make a highlighting color coating system for yourself (for me yellow = any info, orange = terms, pink = important/memorize).

○ Use i-75 youtube videos for topics you are not strong on or during final review

○ Join r/CPA on Reddit or the Becker Facebook groups (there is one for each exam!)

○ During the SIMS part of the exams, use authoritative literature to help look up concepts/verify. Or tax code for REG

○ Do the AICPA Practice exams! They are NOT full length but more accurate idea of how things will be tested (https://www.aicpa.org/resources/article/get-familiar-with-the-cpa-exam-by-practicing-with-our-sample-tests)

● FAR specific advice :

○ Governmental and Not for Profit is HEAVILY tested on MCQ

■ If never learned gov stuff, I would suggest doing F8-F10 modules FIRST while you still have brain cells and then heavily reviewing it/really memorizing during final review

○ Make handwritten cheat sheets for each module/important topics (I did this in undergrad so just continuing that study habit for myself)

● Audit specific advice:

○ Complete A1 Module on Reports AFTER Modules A2-A4. The reports make more sense once you know what goes in them